lor-center74.ru

Tools

How Do You Compound Interest

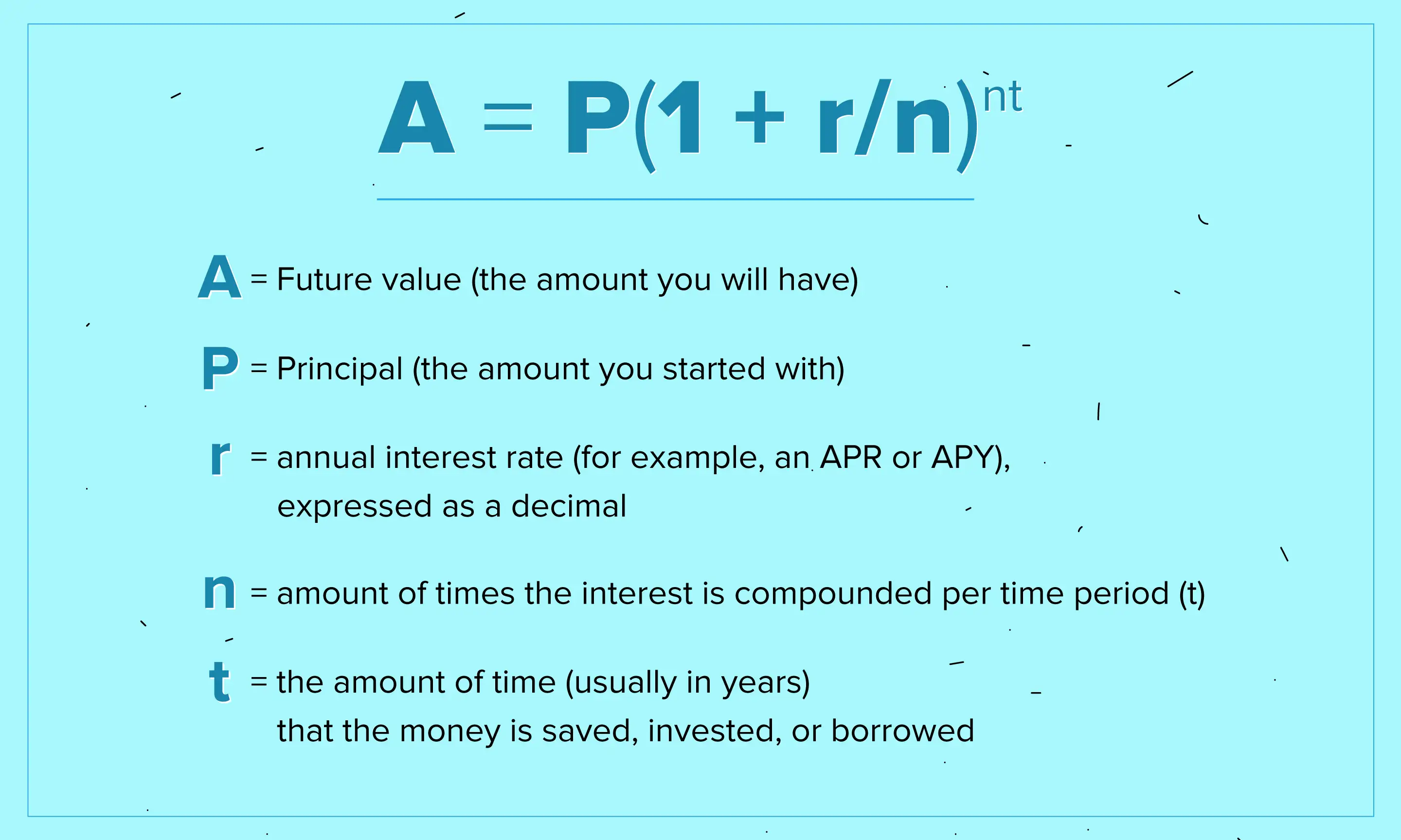

Calculating compound interest. The formula for calculating compound interest is P = C (1 + r/n)nt – where 'C' is the initial deposit, 'r' is the interest rate. With compound interest, accumulated interest is periodically added to your principal—the amount you've put in—and begins earning interest, too. Compounding interest calculator: Here's how to use NerdWallet's calculator to determine how much your money can grow with compound interest. 1. Define annual compounding. The interest rate stated on your investment prospectus or loan agreement is an annual rate. Compound Interest in Borrowing · Using the simple interest method, the borrower pays back the principal plus $ in interest charges. · If, however, the loan. How to calculate compound interest · 1. Divide the annual interest rate of 5% () by 12 (as interest compounds monthly) = · 2. Calculate the. Learn how compound interest works including information on what it is, how it is calculated & how to take advantage of accounts that offer compound interest. Compound interest builds on the principal balance plus accrued interest. If you have $1, at a 2% interest rate compounded annually, you'll earn $20 interest. Compound interest causes your wealth to grow faster. It makes a sum of money grow at a faster rate than simple interest because you will earn returns on the. Calculating compound interest. The formula for calculating compound interest is P = C (1 + r/n)nt – where 'C' is the initial deposit, 'r' is the interest rate. With compound interest, accumulated interest is periodically added to your principal—the amount you've put in—and begins earning interest, too. Compounding interest calculator: Here's how to use NerdWallet's calculator to determine how much your money can grow with compound interest. 1. Define annual compounding. The interest rate stated on your investment prospectus or loan agreement is an annual rate. Compound Interest in Borrowing · Using the simple interest method, the borrower pays back the principal plus $ in interest charges. · If, however, the loan. How to calculate compound interest · 1. Divide the annual interest rate of 5% () by 12 (as interest compounds monthly) = · 2. Calculate the. Learn how compound interest works including information on what it is, how it is calculated & how to take advantage of accounts that offer compound interest. Compound interest builds on the principal balance plus accrued interest. If you have $1, at a 2% interest rate compounded annually, you'll earn $20 interest. Compound interest causes your wealth to grow faster. It makes a sum of money grow at a faster rate than simple interest because you will earn returns on the.

Compound interest is when interest you earn in a savings or investment account earns interest of its own. (So meta.) In other words, you earn interest on both. Periodic compounding · A is the final amount · P is the original principal sum · r is the nominal annual interest rate · n is the compounding frequency · t is. The idea of compound interest (as compared to simple interest) is fundamental to investing because it can ultimately lead to a greater return in your account. Compounding allows you to earn money over time through interest or dividends. Learn more about what compounding interest is and how it works. Compound interest happens when the interest you earn on your savings begins earning interest on itself. Learn how compound interest can increase your. The total amount of principal and accumulated interest at the end of a loan or investment is called the compound amount. This article will explore two different formulas you might need to calculate compound interest and get into some practical applications. Compound interest is an interest calculated on the principal and the existing interest together over a given time period. Compound interest calculations are based on the amounts in all your accounts, even as they change and grow. the interest to be added = (interest rate for one period)*(balance at the beginning of the period). Generally, regardless of the compounding period, the. Interest can be calculated in two ways: simple interest or compound interest. There can be a big difference in the amount of interest payable on a loan. Starting young lets the students take advantage of the magic of "compound interest." Compound interest is the interest you earn on interest. The Rule of 72 is another way to estimate compound interest. If you divide 72 by your rate of return, you will get a rough estimate of how long it'll take for. The compound interest formula can be used to find the amount of interest that has been earned over a period of time. Compound interest can make your savings grow faster. While you earn approximately $ every five years with simple interest, you'll earn interest on the new. The Rule of 72 is another way to estimate compound interest. If you divide 72 by your rate of return, you will get a rough estimate of how long it'll take for. Compound interest is “interest-on-interest”, or the ability of a financial instrument to generate earnings on its earnings. See the compound interest. Each time interest is earned, it is then added to your principal balance. Your new balance becomes the combined total of your earned interest and your original. Generally, the more often the account compounds, the more interest is earned. For example, if you have a principal balance of $3, in a savings account that. Compound interest is the phenomenon that allows seemingly small amounts of money to grow into large amounts over time.

Who Came First Noah Or Abraham

Noah appears as the last of the Antediluvian patriarchs in the traditions of Abrahamic religions. His story appears in the Hebrew Bible (Book of Genesis. the Babylonians (Genesis 1 and Tower of Babel) · Egyptians (stories of Abraham and Joseph, among other places) · Edomites (story of Jacob and Esau [= Edom]). The sum of the years of the First Age. From Adam unto Noah's flood are years For when Adam was years old he begat Seth. Seth being years, begat. You called father Abraham to leave his homeland to journey down pathways to an unknown land. It was because Abraham had faith in Your promises, Lord, that he. He was born 60 years later! Noah would have been years old when Abram was born, but Noah died at years old. Therefore, Noah died 2 years BEFORE Abram. God changed Jacob's name to Israel in Genesis (also see Genesis ). That is, God declared Jacob was the forefather of the nation of Israel. Then. We see here the fundamental distinction between Noah and Abraham. Noah is obedient, he walks with God, but he makes no attempt to intervene; he simply saves. Noah to Abraham. Genesis Dr. Tim Mackie Explore what the flood itself meant in the ancient context of this story and what came after the flood. We first meet Abraham in Genesis Abraham, a descendant of Noah through his son Shem, lived with his family in the city of Ur in Chaldea (today's Iraq). Noah appears as the last of the Antediluvian patriarchs in the traditions of Abrahamic religions. His story appears in the Hebrew Bible (Book of Genesis. the Babylonians (Genesis 1 and Tower of Babel) · Egyptians (stories of Abraham and Joseph, among other places) · Edomites (story of Jacob and Esau [= Edom]). The sum of the years of the First Age. From Adam unto Noah's flood are years For when Adam was years old he begat Seth. Seth being years, begat. You called father Abraham to leave his homeland to journey down pathways to an unknown land. It was because Abraham had faith in Your promises, Lord, that he. He was born 60 years later! Noah would have been years old when Abram was born, but Noah died at years old. Therefore, Noah died 2 years BEFORE Abram. God changed Jacob's name to Israel in Genesis (also see Genesis ). That is, God declared Jacob was the forefather of the nation of Israel. Then. We see here the fundamental distinction between Noah and Abraham. Noah is obedient, he walks with God, but he makes no attempt to intervene; he simply saves. Noah to Abraham. Genesis Dr. Tim Mackie Explore what the flood itself meant in the ancient context of this story and what came after the flood. We first meet Abraham in Genesis Abraham, a descendant of Noah through his son Shem, lived with his family in the city of Ur in Chaldea (today's Iraq).

Adam and Eve were the first humans. After their son Cain killed their other son Abel, they had a son they named Seth. Seth is the ancestor of Noah, who in turn. Abraham, the patriarch of Jews, Christians, and Muslims, was one of the descendants of Arphaxad. In medieval and early modern European tradition he was. Noah not only served as one of God's prophets but was also a ministering angel after he died and brought heavenly messages before the birth of Christ and during. His brothers also came and fell down before him and said, "Behold, we are your servants." But Joseph said to them, "Do not fear, for am I in the place of God. Adam, Noah, Abraham, Moses, David. Who actually "came first" and what is the likely order of their existence?: r/AcademicBiblical. Why was Noah silent before God at the end of the world? Trusting God enough to argue. WHEN FACED WITH the destruction of Sodom and Gomorrah, Abraham argued with. The genealogies in the Old Testament show that Noah died while Abraham's father was living. Noah's father, Lamech, was born about eighty years before Adam died. From Noah to Abraham (originally Abram), the Patriarch of the Hebrews and Arabs, there were also ten generations, making him the tenth Patriarch from Noah. Noah was even the first to receive a brit, a covenant from God. But he does not merit the covenant that will be the Torah's primary focus starting in next. According to jews, Abrahaw was the first jew or patriarch. and yes since both Adam and Noah came before Abraham, then what is their religion? BC Noah and his family are the only survivors of a worldwide flood. Hundreds of years before Abraham was born the Sumerians had become highly civilized. Noah has Shem who was two years after the Flood. Genesis Abraham is listed first; yet Shem was not the oldest. From the lineage of. From Adam to Noah is yrs. + Noah's age at time of the flood · Terah · · Abram · = · (Ge. ) Abraham was 75 when his father died. Terah was. Shem is listed first because he was most important in propagating the Godly line that led from Noah to Abraham, through whose seed (Jesus Christ, the Son of God). The survivor of God's great flood. Noah obediently builds the large ark, or boat, that saves the human race and the animal kingdom from destruction. Noah is the. Before the flood, God respects human freedom and offers all people the option of avoiding the impending doom. He then rescues Noah and a remnant of human beings. Centuries before Abraham's time, God made a covenant with Noah, assuring Noah was grateful to the Lord who had delivered him from the flood. After. Abraham stopped before he asked for the whole of the city. Now we read in chapter 19, and verse 1,. “And there came two angels, (now you see, the two men who. Timeline: From Adam to Abraham · Noah was years old during the flood (Genesis ). · Noah's son Shem was years old when his son Arphaxad was born, 2.

How Can I Refinance My Mortgage

The Refinancing Process Explained Once you decide that refinancing is the right choice for you, submit an application and any necessary documents. We'll. Getting a new mortgage to replace the original is called refinancing. Refinancing is done to allow a borrower to obtain a better interest term and rate. The. When you refinance your home loan, your new lender pays off your old home mortgage loan with the new loan. That, in essence, is the reason for the term “. Eligible members can complete an online application for a mortgage loan refinance with SECU in as little as 10 minutes. The application will ask you questions. Has your income increased? Do you need to consolidate debt? Has the equity in your home increased? Do you need money for a major expense? Refinancing for a lower mortgage refinance rate would help you pay less toward interest and more toward the principal of your mortgage. Q: Is now a good time to. Generally speaking, refinancing your mortgage can be a good idea when today's interest rates are significantly lower than the rate on your current mortgage. You can refinance a home with a Conventional, VA, FHA, or USDA loan. Which one you choose depends on factors such as your current loan type, your financial. A refinance, or refi for short, refers to revising and replacing the terms of an existing credit agreement, usually as it relates to a loan or mortgage. The Refinancing Process Explained Once you decide that refinancing is the right choice for you, submit an application and any necessary documents. We'll. Getting a new mortgage to replace the original is called refinancing. Refinancing is done to allow a borrower to obtain a better interest term and rate. The. When you refinance your home loan, your new lender pays off your old home mortgage loan with the new loan. That, in essence, is the reason for the term “. Eligible members can complete an online application for a mortgage loan refinance with SECU in as little as 10 minutes. The application will ask you questions. Has your income increased? Do you need to consolidate debt? Has the equity in your home increased? Do you need money for a major expense? Refinancing for a lower mortgage refinance rate would help you pay less toward interest and more toward the principal of your mortgage. Q: Is now a good time to. Generally speaking, refinancing your mortgage can be a good idea when today's interest rates are significantly lower than the rate on your current mortgage. You can refinance a home with a Conventional, VA, FHA, or USDA loan. Which one you choose depends on factors such as your current loan type, your financial. A refinance, or refi for short, refers to revising and replacing the terms of an existing credit agreement, usually as it relates to a loan or mortgage.

Mortgage refinancing to a more favorable term or lower interest rate can save a significant amount of money over the life of your loan. Or changing your. Refinancing replaces an existing mortgage with a new one, and you can customize details on the new loan including the type of interest rate, the term length. From lowering your monthly mortgage payment to consolidating debt, a mortgage refinance can help you reach your financial goals. Mortgage refinancing can help. PNC Bank can help you get started with the mortgage refinance process. Learn more about home loan refinancing and how it could help you today! The most common reason is to lower your interest rate, to reduce the amount of interest you'll pay and typically also to lower the payment. Say. Refinancing a house means you replace the mortgage you have with a new mortgage that has more favorable terms. Whether or not you should refinance depends on. How to Refinance a Home. · Submit application and documents. Your lender will review your income, assets, debt and credit score to determine what rate and terms. Maybe you want to lower your monthly payment, change the loan term, get a lower interest rate, or tap into your home equity for other expenses. When you exchange your existing mortgage for a larger loan and take the difference in cash, it's called a cash-out refinance. You can use this cash to help pay. Sign in to online banking using the link below with your Navy Federal username and password. Select “I want to refinance my home” and follow the steps to submit. One of the best and most common reasons to refinance is to lower your loan's interest rate. Historically, the rule of thumb has been that refinancing is a good. Key takeaways · Refinancing a home is a big decision that depends on your financial situation, available interest rates and your long-term plans for staying in. Refinance. Refinance your existing mortgage to lower your monthly payments, pay off your loan sooner, or access cash for a large purchase. Use our home value. Many lenders will require at least a year of payments before refinancing your home. Some refuse to refinance in any situation within to days of issuing. Most experts recommend refinancing a mortgage if you can lower your current interest rate by at least to 1 percent. Also, it's a good idea not to plan to. Home mortgage refinancing can potentially lower your monthly payments by replacing your current mortgage with a new one that has more favorable loan terms. Refinancing your mortgage basically means that you are trading in your old mortgage for a new one, and possibly save money in the process. Please call () , email us, or find a loan officer serving your community to learn more about a specific APR for your transaction. Monthly payments. Talk with potential lenders about your plans, what options your income, credit score and equity position give you, and what loan programs are available to you. Refinancing your home mortgage allows you to pay off your original mortgage with a new loan. Typically, people refinance their original mortgage loan for one or.

How Much Should Auto Insurance Cost Per Year

The average insurance cost for all vehicles, including pickups and hybrid and electric vehicles, was $1, These cost estimates are based on a full coverage. Get a quote or talk to an agent to find out how much you could save. ZIP *Based on average nationwide annual savings of new customers surveyed. The national average cost for full coverage car insurance is $2, per year, or $ per month. Drivers with minimum coverage pay an average of $ a year, or. AAA Discounts & Rewards Members save an average of $ a year by using AAA discounts. Insurance premium does not include the price of Membership. Insurance. And our customers agree, rating us as one of the top vehicle insurers in the U.S. for customer service, claims handling and pricing Adjusting rear-view. Drivers who buy full-coverage car insurance pay an average of $ per month, or $2, per year. As a driver, your exact insurance costs will depend on various. study found that the average cost to own and operate a model vehicle was $9, in when the vehicle is driven 15, miles per year. The average full-. Simplify car insurance before you quote. Your policy's coverage selections depend on what your state requires, how much you have to protect, whether your. The average cost of car insurance is $ per year for drivers with minimum coverage and a clean record, according to WalletHub's research. The average insurance cost for all vehicles, including pickups and hybrid and electric vehicles, was $1, These cost estimates are based on a full coverage. Get a quote or talk to an agent to find out how much you could save. ZIP *Based on average nationwide annual savings of new customers surveyed. The national average cost for full coverage car insurance is $2, per year, or $ per month. Drivers with minimum coverage pay an average of $ a year, or. AAA Discounts & Rewards Members save an average of $ a year by using AAA discounts. Insurance premium does not include the price of Membership. Insurance. And our customers agree, rating us as one of the top vehicle insurers in the U.S. for customer service, claims handling and pricing Adjusting rear-view. Drivers who buy full-coverage car insurance pay an average of $ per month, or $2, per year. As a driver, your exact insurance costs will depend on various. study found that the average cost to own and operate a model vehicle was $9, in when the vehicle is driven 15, miles per year. The average full-. Simplify car insurance before you quote. Your policy's coverage selections depend on what your state requires, how much you have to protect, whether your. The average cost of car insurance is $ per year for drivers with minimum coverage and a clean record, according to WalletHub's research.

Insurance Coverage · What's most important to you when shopping for insurance? Lowest cost ; Car Ownership · For the most expensive vehicle you'd like to insure. In , the national average monthly cost for commercial auto insurance through Progressive ranged from $ for contractor autos to $1, for for-hire. Last year, the average cost of car insurance for individuals in the US was around $1, per year. This can vary a lot depending on factors. In In , the average annual cost for auto insurance in the United States was $1, per vehicle, or about $ monthly, per vehicle.***1 Our figures are. The average cost of car insurance ranges from $ to $ per month for a liability-only policy from Progressive. Annual Rates for Good Drivers ; Nationwide. $1, $ ; Geico. $1, $ ; Progressive. $1, $ ; National Average. $2, -. Auto insurance tends to be cheaper once drivers reach 25 years old. Drivers in their 60s pay the lowest premiums, averaging just $79 per month for liability-. Adding a year-old to an adult's policy costs on average $ per month, according to Investopedia research. The cost of car insurance for teens depends on. In a recent survey by lor-center74.ru, 43% of homeowners indicated their insurance premiums have increased in the past year, rising to an average of $1, In , the average cost of car insurance is $/year which comes to $ per six-month policy or $/month. Use The Zebra to compare prices. According to the American Auto Association (AAA), the average cost to insure a mid-size sedan in was $ a year, or approximately $ per month. The car you drive – The cost of your car is a major factor in the cost to insure it. Other variables include the likelihood of theft, the cost of repairs, its. How much is the average cost of car insurance in the U.S? The average cost for car insurance in the United States is $1, per year, or $ per month. On average, a Chrysler costs $2, per year for car insurance, or about $ per month. This is a better rate than the majority of popular brands. While this. Drivers in the U.S. pay an average of $1, per year for full coverage car insurance, or about $ per month, according to Bank rate's On average, a Chrysler costs $2, per year for car insurance, or about $ per month. This is a better rate than the majority of popular brands. While this. Vehicles registered as taxis must carry bodily injury liability (BIL) coverage of $, per person, $, per occurrence and $50, for (PDL) coverage. How Much You Drive. If you drive a lot each year, it could affect your premium. Ways to save on car insurance. Regardless of what you drive, we offer many. It can cost as little as $ monthly or $ annually for businesses such as yoga instructors and accountants, but the exact commercial auto insurance cost.

Make Money Trading Cryptocurrency

Cryptocurrency trading involves speculating on price movements via a CFD trading account, or buying and selling the underlying coins via an exchange. Here you'. Strategies to Make Money with Cryptocurrency · 1. Investing · 2. Trading · 3. Mining · 4. Staking · 5. Buy & Exchange NFT's · 6. Play-to-Earn Games. You will need to have over 50% of trades profitable to make money. Now let's say your risk is half of your potential reward ( risk:reward. The easiest way to start generating crypto rewards on Coinbase is through Coinbase Earn. In exchange for learning the basics about certain cryptocurrencies. It's an online platform and digital marketplace where eligible participants can check and compare cryptocurrency prices, buy and sell virtual currencies. Cryptocurrency is a medium of exchange, created and stored electronically on the blockchain, using cryptographic techniques to verify the transfer of funds and. This beginner's guide discusses how to make money with cryptocurrency using 10 proven methods. Start making crypto profits today. Trading cryptocurrency can help you make huge profits. However, it also has inherent risks. You can win or lose a large amount of money quickly. This means. Trading cryptocurrencies is an active approach to profiting from the market's fluctuating prices. Traders use a variety of methods, including technical analysis. Cryptocurrency trading involves speculating on price movements via a CFD trading account, or buying and selling the underlying coins via an exchange. Here you'. Strategies to Make Money with Cryptocurrency · 1. Investing · 2. Trading · 3. Mining · 4. Staking · 5. Buy & Exchange NFT's · 6. Play-to-Earn Games. You will need to have over 50% of trades profitable to make money. Now let's say your risk is half of your potential reward ( risk:reward. The easiest way to start generating crypto rewards on Coinbase is through Coinbase Earn. In exchange for learning the basics about certain cryptocurrencies. It's an online platform and digital marketplace where eligible participants can check and compare cryptocurrency prices, buy and sell virtual currencies. Cryptocurrency is a medium of exchange, created and stored electronically on the blockchain, using cryptographic techniques to verify the transfer of funds and. This beginner's guide discusses how to make money with cryptocurrency using 10 proven methods. Start making crypto profits today. Trading cryptocurrency can help you make huge profits. However, it also has inherent risks. You can win or lose a large amount of money quickly. This means. Trading cryptocurrencies is an active approach to profiting from the market's fluctuating prices. Traders use a variety of methods, including technical analysis.

Those who have a good understanding of market trends and are able to make informed trading decisions can earn profits through trading. Airdrops: Airdrops. It doesn't matter how much scam trading websites claim you will earn, or how easy or risk-free they say it will be, you will lose any money you give them. Crypto day trading primarily involves buying and selling crypto assets within a single trading day. The goal is to make a profit from the price movements of. Centralized crypto exchanges (CEX) are managed by one organization. Centralized exchanges make it easy to get started with cryptocurrency trading by. Follow six steps to easily start trading cryptocurrency. See crypto trading examples, learn how markets work and find out how to place your first trade. The main goal is to earn dollars or any other currency. Experts recommend understanding the market trends and short-term price trends if you want to excel in. Trading digital assets is a common method for profit in the cryptocurrency space. The idea is simple: buy low, sell high. Platforms like Noones make it easy to. Way#1. Buy and HODL · Way#2. Earn Cryptocurrency Dividends · Way#3. Run Cryptocurrency Master Nodes · Way#4. Stake Cryptos · Way#5. Day Trading · Way#6. Help Out. Just like with any investment opportunity, there are no guarantees. No one can guarantee you'll make money off your investment. Anyone who promises you a. While not all cryptos are same, they all pose high risks and are speculative as an investment. You should never invest money into crypto that you can't afford. Learn more about the numerous ways to make money with cryptocurrency; from staking, lending, investing in startups and more. It's possible to make money by trading cryptocurrencies like Bitcoin daily. It's called day trading. You buy low and sell high to make a profit. The main source of revenue for most cryptocurrency exchanges is transaction fees. These commissions are charged on every purchase, sale or exchange of. The fascination with these currencies appears to have been more speculative (buying cryptocurrencies to make a profit) than related to their use as a new and. A cryptocurrency, crypto-currency, or crypto is a digital currency designed to work as a medium of exchange through a computer network that is not reliant. The best profits are typically obtained by staking a smaller-cap token over a long lock-up period. In contrast, betting on a large-cap coin like Ethereum over a. Finally, regardless of what anyone tells you, investing in or purchasing crypto assets does not guarantee that you'll make a lot of money — and if someone is. Buy the coins sliding and sell those pumping, you can seize these price moves by running your orders using a automatic trading plan. Managing your crypto. Trading is one of the most popular ways to make money with cryptocurrencies. By analyzing market charts and making accurate predictions, traders. exchange rates, with some cryptocurrencies showing 10,% growth, it is making the currency even less traceable than “normal” cryptocurrencies.

Can You Lose 60 Pounds In 4 Months

I wouldn't recommend doing Yoga since it has some spiritual dangers to it. But I'm glad that you've been losing the weight and keeping it. you can begin losing weight again if you want or need to. A plateau can last I lost 30 pounds in 9 months and still have 15 pounds to go. I eat. Samantha Costa, a year-old influencer, lost a whopping 60 pounds in 3 months. In a viral YouTube video she explains exactly how she did it. You'll need to cut out at least calories daily. One pound is equivalent to 3, calories, so you'll need to lose 87, (3, x 25) over 60 days. To. Most people should aim to lose % of their body weight per week. This means that in a 60 day period, you could lose between % of your body weight. 60 lbs in 8 months is ambitious, but doable. You will have to be really strict for 8 months. No cheat days, No eating out, consistently exercising. Yes, you can lose a significant amount of weight in 6 months. Working on both your diet and exercise will help you lose weight faster. 3 months workout · Avatar. The Fit Life · 3 Month Workout Plan · 3 Month Workout ; How I Lost 67 Pounds · L · Lucy Butler · 10 Days 10 Kg Diet · Lose 15 Pounds One. I used to weight lbs in the Army and I felt my best. I think I can do it again. I am on day 3 and am losing 1lb per day so far. I will let. I wouldn't recommend doing Yoga since it has some spiritual dangers to it. But I'm glad that you've been losing the weight and keeping it. you can begin losing weight again if you want or need to. A plateau can last I lost 30 pounds in 9 months and still have 15 pounds to go. I eat. Samantha Costa, a year-old influencer, lost a whopping 60 pounds in 3 months. In a viral YouTube video she explains exactly how she did it. You'll need to cut out at least calories daily. One pound is equivalent to 3, calories, so you'll need to lose 87, (3, x 25) over 60 days. To. Most people should aim to lose % of their body weight per week. This means that in a 60 day period, you could lose between % of your body weight. 60 lbs in 8 months is ambitious, but doable. You will have to be really strict for 8 months. No cheat days, No eating out, consistently exercising. Yes, you can lose a significant amount of weight in 6 months. Working on both your diet and exercise will help you lose weight faster. 3 months workout · Avatar. The Fit Life · 3 Month Workout Plan · 3 Month Workout ; How I Lost 67 Pounds · L · Lucy Butler · 10 Days 10 Kg Diet · Lose 15 Pounds One. I used to weight lbs in the Army and I felt my best. I think I can do it again. I am on day 3 and am losing 1lb per day so far. I will let.

If you're thinking a once-weekly injection will magically help you lose weight, think again. By Zee Krstic Published: Mar 11, AM EST. Verified. Yes, you can, but the extent to which you are currently overweight will be a Your ideal body weight would therefore be lbs. the general. Most studies report that people who stick to the diet and exercise plan outlined below can drop the last 10 lbs in about 60 to 90 days. Here is the deal on weight loss. 60 pounds is a huge amount of weight to lose in months. You are looking at about 60 pounds in 15 weeks or a solid 4 pounds. Go to channel How I lost 60 Pounds in 4 Months! Dealing with Binge Eating, Body Dysmorphia, and Food Addiction SarahAlaba•K views. I understood that to lose weight you need to decrease calories and increase physical activity. To lose 1 pound you need to either burn calories through. Many new moms would like to lose those extra pounds after giving birth. Here's how to lose weight in the postpartum period in a safe and effective way. Take a minute, plug your information into the weight loss calculator and discover the maximum daily calorie amount that will help you lose 1 pound per week. How to lose 20 lbs in 4 months??? Reply. Liked by creator. 3. View more replies (1). Andrew. can you do a video of eating healthy in a. How to lose 20 lbs in 4 months??? Reply. Liked by creator. 3. View more replies (1). Andrew. can you do a video of eating healthy in a. Very candid and straight forward approach to how I was able to lose 60 pounds in 4 months. Equipped with a list of foods, what I ate at breakfast, lunch. I also have to say, that my body has some specifics: I usually gain weight pretty easy, but can lose it fast as well. So, here is my regime for first 3 months. Once you master your mind, you can master anything. I'm How to lose weight FAST | My 80 pounds Weight Loss Tips guaranteed to work . And it's not just a little weight — it's a loss of 10 pounds or 5% of your body weight in six to 12 months. It can be a symptom of a serious illness, like. But many health care providers agree that a medical evaluation is called for if you lose more than 5% of your weight in 6 to 12 months, especially if you're an. While you can lose 20 pounds (lbs) in a month, this is neither safe nor sustainable. Losing weight more steadily with the right diet and exercise can help you. to lose 60 pounds by the end of the school year in June. I knew it was a If I can do it, you can too. lor-center74.ru I had a goal to lose weight, perhaps like some of you today, but was making no long-term progress. Sure, I could lose pounds in a month. The Ultimate Guide to Losing 60 Pounds in 6 Months: A Simple and Sustainable Approach: The Only Diet and Exercise Plan You'll Ever Need [WOLFE. That means, on average, that aiming for 4 to 8 pounds of weight loss per month is a healthy goal. Just because it's possible to lose a lot more, at least in the.

How Do I Cancel A Paypal Order

You cannot cancel a PayPal payment! To get your money back: Until you do this there is nothing you can do as at this stage it is just 'buyer remorse.'. To cancel the order in the case you have identified you would need to customise the plugin. Yes you can cancel on return but I am guessing there is no special. You can cancel a PayPal Credit payment before the scheduled date by logging in, clicking on PayPal Credit, selecting the payment, and clicking cancel. Cancellation. To cancel your CDJapan order paid by PayPal, please contact us by email ([email protected]). Please make sure to include your order number. If. Go to Activity. · Click Cancel under the payment in question. · Follow the steps to cancel the payment. I went on PayPal to cancel the order and get a refund but the transaction is not showing up. It's been days now and despite the money being withdrawn from. Open your Activity History · Choose the transaction you wish to cancel and click on the transaction ID · Click the Cancel icon and confirm the action on the pop-. If the order is canceled by you or changed, the PayPal funds will NOT be transferred. It will continue to show as a "pending" transaction in your PayPal account. To cancel a PayPal payment after it has been completed, you will need to contact the recipient directly and request a refund. If the recipient. You cannot cancel a PayPal payment! To get your money back: Until you do this there is nothing you can do as at this stage it is just 'buyer remorse.'. To cancel the order in the case you have identified you would need to customise the plugin. Yes you can cancel on return but I am guessing there is no special. You can cancel a PayPal Credit payment before the scheduled date by logging in, clicking on PayPal Credit, selecting the payment, and clicking cancel. Cancellation. To cancel your CDJapan order paid by PayPal, please contact us by email ([email protected]). Please make sure to include your order number. If. Go to Activity. · Click Cancel under the payment in question. · Follow the steps to cancel the payment. I went on PayPal to cancel the order and get a refund but the transaction is not showing up. It's been days now and despite the money being withdrawn from. Open your Activity History · Choose the transaction you wish to cancel and click on the transaction ID · Click the Cancel icon and confirm the action on the pop-. If the order is canceled by you or changed, the PayPal funds will NOT be transferred. It will continue to show as a "pending" transaction in your PayPal account. To cancel a PayPal payment after it has been completed, you will need to contact the recipient directly and request a refund. If the recipient.

1. Visit the PayPal website and log in to your account with your email address and password. 2. Click the "History" tab and browse through the recent. 1 Answer 1 When an order is created, it is valid for 72 hours. When an order becomes approved, it is valid for 3 hours. There is no method to. In that case, the status of the order is the one activated under the "cancelled" column of the System>Order statuses menu. You could deactivate the statuses. To cancel a completed payment, contact the seller for a refund or return. If not resolved, open a dispute within the correct dispute-filing timeframe. If you sent a payment to the wrong person and the payment status shows as unclaimed, you can cancel it. Go to your Activity, find the payment, and click Cancel. You can cancel a PayPal Credit payment before the scheduled date by logging in, clicking on PayPal Credit, selecting the payment, and clicking cancel. 2 Answers 2 If the v2 order was intent:'authorize' and you 'COMPLETED' it to get back an authorization object, you can void the authorization. Preapproved payments must be canceled within 24 hours of the next scheduled payment or your account will be charged. References. When a buyer is unhappy with a transaction, they can open up a dispute in the PayPal Resolution Center. The seller will get a message explaining the buyer's. PayPal, Refunds, and Canceled Orders · PayPal Payments Solution FAQ · Understanding The Discogs Selling Fee · What Is The Difference Between Cancellation And. You cannot cancel a PayPal payment! To get your money back: Until you do this there is nothing you can do as at this stage it is just 'buyer remorse.'. To cancel a completed payment, contact the seller for a refund or return. If not resolved, open a dispute within the correct dispute-filing timeframe. 1. Log in to your PayPal account. 2. Click on the "Activity" tab at the top of the page. 3. Locate the transaction you want to cancel and click. Here is how to Cancel a Pending Transaction straight from the Paypal site. Can I Cancel a Payment? If that doesn't work, I would get in contact with an EA Game. You can cancel a payment you've sent if its status is 'Unclaimed' in the 'Payment Status' column. 'Unclaimed' means the recipient has not received or accepted. Tap Accounts. · Tap Autopay. · Tap the merchant to view or update. · Tap Remove PayPal as your payment method. In the PayPal app: · Open your settings by clicking the wheel at the top of the app · Select "Automatic Payments" · Select the subscription you would like to. When your order is cancelled through our system, PayPal will refund any amount paid and cancel any future scheduled payments. How do I cancel a claim or return order on PayPal? You can cancel a claim or return request by following these instructions. To cancel and refund manual (offline) orders; · Enter the amount you refunded the customer. · (Optional) Select the Update inventory checkbox to add the products.

Current No Cost Refinance Rates

Refinance rates ; yr fixed · % · % ; yr fixed FHA · % · % ; yr fixed · % · % ; yr fixed · % · %. See current mortgage refinance rates from Discover Home Loans. Low fixed rate loans come with $0 application fees, $0 origination fees, $0 appraisal fees. On Saturday, September 07, , the national average year fixed refinance interest rate is %, remaining stable over the last week. Meanwhile, the. We update the interest rate table below daily, Monday through Friday, so you have the most current refinance rates available. no cost mortgage refinancing is a popular way to take advantage of falling interest rates. just be sure to refinance to a lower rate and pay the closing costs. Lastly, if you can have your closing costs covered by a lender credit and still lower your interest rate from your current mortgage, then the no cost refinance. Compare mortgage rates when you buy a home or refinance your loan. Save money by comparing free, customized mortgage rates from NerdWallet. View current refinance rates in your area and see how much you can save. You can refinance your mortgage with low closing costs. The average APR on the year fixed-rate jumbo mortgage refinance is %. Last week, the average APR on a year jumbo was %. Read In-depth Refinance. Refinance rates ; yr fixed · % · % ; yr fixed FHA · % · % ; yr fixed · % · % ; yr fixed · % · %. See current mortgage refinance rates from Discover Home Loans. Low fixed rate loans come with $0 application fees, $0 origination fees, $0 appraisal fees. On Saturday, September 07, , the national average year fixed refinance interest rate is %, remaining stable over the last week. Meanwhile, the. We update the interest rate table below daily, Monday through Friday, so you have the most current refinance rates available. no cost mortgage refinancing is a popular way to take advantage of falling interest rates. just be sure to refinance to a lower rate and pay the closing costs. Lastly, if you can have your closing costs covered by a lender credit and still lower your interest rate from your current mortgage, then the no cost refinance. Compare mortgage rates when you buy a home or refinance your loan. Save money by comparing free, customized mortgage rates from NerdWallet. View current refinance rates in your area and see how much you can save. You can refinance your mortgage with low closing costs. The average APR on the year fixed-rate jumbo mortgage refinance is %. Last week, the average APR on a year jumbo was %. Read In-depth Refinance.

Today's competitive refinance rates ; Rate % ; APR % ; Points ; Monthly Payment $1,

Lender pays for closing costs and charges an interest rate higher than market. If this is lower than what I currently have, its a net win with. Today's competitive refinance rates ; Rate · % · % · % ; APR · % · % · % ; Points · · · With our easy, no-refi rate drop, you can buy a home now and if our rates drop later, you could lower your rate for a one-time $ fee. In the past year, the average year fixed mortgage rate ranged from % to %. FAQ: Editors' answers. How does refinancing work? Today's year fixed refinance rates ; Conventional fixed-rate loans · year. % ; Conforming adjustable-rate mortgage (ARM) loans · 10/6 mo. % ; Jumbo. SM Fremont Bank was one of the first lenders to offer a No Closing Cost mortgage and has a proud history of offering this to our clients for over 20 years. Check today's mortgage rates for refinancing to get cash out, pay your mortgage off faster and more. Connect with us to estimate your personalized rate. “Or, as a substitute for evading closing costs, you can pay an interest rate that is slightly higher than the current interest rate.” Accepting a higher rate. A no closing cost refinance is mortgage refinancing that helps cover closing costs. So, if you're looking to refinance but don't have the cash to cover. Current Mortgage Refinancing Rates. Ready to refinance your home? Apply Call for more information. Interest rate as low as. %. APR. Discover mortgage refinance rates at Citizens to access cash, reduce payments, or pay for home improvements. Today's mortgage refinance rates await you. September refinance rates currently average % for year fixed loans and % for year fixed loans. Get a lower interest rate · Get cash out. How a no-closing-cost refinance works ; Interest rate, %, % ; Monthly payment (principal and interest), $1,, $2, ; Total interest costs. Your interest rate is affected by the type of refinance loan you want, your credit score, your income and finances, as well as the current mortgage market. Conforming and Government LoansExpand Opens DialogExpand · Year Fixed Rate · Interest% · APR%. A no-cost refinance is a refinance in which the lender provides credit in exchange for a slightly higher rate to cover all lender and third-party closing costs. Get current refinance rates at loanDepot, a direct lender with low rates on home refinance mortgage loans charge of estimating your mortgage payment. The average APR on a year fixed-rate mortgage remained at % and the average APR for a 5-year adjustable-rate mortgage (ARM) fell 1 basis point to %. National year fixed refinance rates go down to %. The current average year fixed refinance rate fell 17 basis points from % to % on Friday.

How Much Sq Ft Does 1 Gallon Of Paint Cover

Two gallon cans of paint cover up to square feet, which is enough to cover an average size room. This is the most common amount needed. paint, find out exactly how much you'll need. If more than one room is being painted with the same color, add up the total square footage. PLEASE NOTE. Q: How many square feet does a gallon of paint cover? A: With typical application, a gallon of paint covers about square feet. * Note: Each gallon of paint can cover roughly square feet. If you're cover up to square feet with a single coat of paint. Per the chart. How much paint do I need? A one-gallon can of paint will cover up to square feet, enough to cover a small bathroom. Two-gallon cans. 1 gallon of paint will cover up to sq. ft. ( sq. meters) per U.S. Coverage figures do not include material loss due to application. Some. square feet per gallon is EXTEREMELY GENEROUS. Especially considering that the TDS states which still depends on color and the. Generally, a quart of paint covers about square feet, and a gallon of paint covers square feet. Some additional considerations before you begin. In general, one gallon of paint or primer will cover roughly square feet of surface. Save time and money with the KILZ paint calculator to estimate. Two gallon cans of paint cover up to square feet, which is enough to cover an average size room. This is the most common amount needed. paint, find out exactly how much you'll need. If more than one room is being painted with the same color, add up the total square footage. PLEASE NOTE. Q: How many square feet does a gallon of paint cover? A: With typical application, a gallon of paint covers about square feet. * Note: Each gallon of paint can cover roughly square feet. If you're cover up to square feet with a single coat of paint. Per the chart. How much paint do I need? A one-gallon can of paint will cover up to square feet, enough to cover a small bathroom. Two-gallon cans. 1 gallon of paint will cover up to sq. ft. ( sq. meters) per U.S. Coverage figures do not include material loss due to application. Some. square feet per gallon is EXTEREMELY GENEROUS. Especially considering that the TDS states which still depends on color and the. Generally, a quart of paint covers about square feet, and a gallon of paint covers square feet. Some additional considerations before you begin. In general, one gallon of paint or primer will cover roughly square feet of surface. Save time and money with the KILZ paint calculator to estimate.

The average bedroom requires 1 gallon ( litres) of wall paint. A one gallon ( litre) can of wall paint covers about – square feet (35 to According to Lowe's, a gallon of primer covers about – square feet, and a gallon of paint usually covers – square feet. First, one gallon of paint will cover about square feet. Next, remember most painting projects will require at least two coats of paint to ensure quality of. 1 gallon of paint will cover up to sq. ft. ( sq. meters) per U.S. Coverage figures do not include material loss due to application. Some. One gallon of Ceiling Paint will cover approximately square feet. One gallon of Primer will cover approximately square feet. *These estimates. Generally, a gallon covers sq ft. To determine the paint needed for a 12×12 room, calculate the wall square footage. Multiply wall length by height. Results. 40 lor-center74.ru Number of Coats. 1, 2, 3, 4. You need 0 gallons. Congratulations! You now know how much paint you need to complete your painting project. Now. A one gallon ( liter) can of wall paint covers about – square feet (35 to 37 square meters). Calculate one room at a time and determine if you. On average (key word: average), a standard gallon of paint typically covers between to square feet of surface area. That said, a good rule of thumb is that one gallon of paint will cover between and sq. ft. Planning ahead will help you determine the amount of paint. On average, a gallon of paint covers approximately square feet of surface area with a single coat. In general, you can expect 1 gallon of Benjamin Moore paint to cover about square feet. You need slightly more than a gallon if the walls are unpainted. As a guideline, one gallon of paint can cover anywhere from square feet of interior walls, for one coat. Most interior doors are about 20 square feet. For a 20 square foot door, you need about mL of paint for one coat. How much trim does a gallon of paint cover. The general rule of thumb, however, is that 1 gallon of latex paint will cover to sq ft. How much paint do you need for a 12x12 room? Most likely. One gallon covers approximately square feet (37 square meters). For best results, we recommend planning for 1 coat of Jolie Primer and at least 2 coats of. One gallon of Interior BEHR ULTRA® SCUFF DEFENSE™ Paint and Primer, or BEHR PREMIUM PLUS® is enough to cover to Sq. Ft. of surface area with one coat. Finally, if the paint is known to cover ft2 per gallon, and given that two coats are needed, divide the square footage by the paint coverage, then multiply. One gallon of any BEHR paint is enough to cover between to square feet of surface area with one coat. Step 2. To determine the number of coats your. Per gallon, our paint covers approximately sq. ft., primer covers sq. ft. and ceiling paint covers sq. ft. Explore Colors.

Trin Index Today

Arms Index or TRIN = (advancing issues / declining issues) / (composite volume of advancing issues / composite volume of declining issues). Generally, an. NYSE - Short-Term Trading Arms Index (TRIN) ($TRIN). LAST (21 May). today to get even more out of your StockCharts subscription. Upgrade. Trin Chart - Live NYSE Trin. Also referred to as ARMS index, Trin is a measurement of strength or weakness in the markets London Market Today - This. Today's Range: - - 52 Week Range: - - -- Stocks. Index, Last, % Change. S&P , 5,, Euro STOXX 50, 4,, + Trending Indexes. Data as of Aug 24, COMP. Nasdaq Composite Index Register for your free account today at lor-center74.ru Nasdaq link logo. The Arms Index, developed by Richard Arms, is also referred to as TRIN, an acronym for TRading INdex. It is a volume-based indicator, which determines market. Get detailed information on the NYSE Short Term Trade Index including charts, technical analysis, components and more. Discover historical prices for C:TRIN stock on Yahoo Finance. View daily, weekly or monthly format back to when NYSE SHORT TERM TRADE INDEX stock was. The Arms Index, also known as the TRIN (Short-Term TRading INdex), was developed by Richard Arms in the s. It is calculated by dividing the ratio of. Arms Index or TRIN = (advancing issues / declining issues) / (composite volume of advancing issues / composite volume of declining issues). Generally, an. NYSE - Short-Term Trading Arms Index (TRIN) ($TRIN). LAST (21 May). today to get even more out of your StockCharts subscription. Upgrade. Trin Chart - Live NYSE Trin. Also referred to as ARMS index, Trin is a measurement of strength or weakness in the markets London Market Today - This. Today's Range: - - 52 Week Range: - - -- Stocks. Index, Last, % Change. S&P , 5,, Euro STOXX 50, 4,, + Trending Indexes. Data as of Aug 24, COMP. Nasdaq Composite Index Register for your free account today at lor-center74.ru Nasdaq link logo. The Arms Index, developed by Richard Arms, is also referred to as TRIN, an acronym for TRading INdex. It is a volume-based indicator, which determines market. Get detailed information on the NYSE Short Term Trade Index including charts, technical analysis, components and more. Discover historical prices for C:TRIN stock on Yahoo Finance. View daily, weekly or monthly format back to when NYSE SHORT TERM TRADE INDEX stock was. The Arms Index, also known as the TRIN (Short-Term TRading INdex), was developed by Richard Arms in the s. It is calculated by dividing the ratio of.

The TRIN indicator, which changed the way traders look at the stock market's range of activity, gives a detailed view into what people feel about the market. It. The index has been most commonly referred to as "TRIN"; however, today the index appears as "ARMS" on mostquotation lor-center74.ru Arms index has changed the way. The Arms Index is also called the Trin (short for “Trading Index”) because it seeks to indicate overbought or oversold conditions by serving as an index of. Arms Index or TRIN = (advancing issues / declining issues) / (composite volume of advancing issues / composite volume of declining issues). Generally, an. Technical stocks chart with latest price quote for NYSE Trin, with technical analysis, latest news, and opinions. Indicator Analysis of NyseTrin Tomorrow's movement Prediction of Nyse Trin TRIN appears to be in downtrend. But this trend seems to be weakening. Price is. NYSE Short Term Trade Index Index Today (STI.N). View live NYSE TRIN share price charts, technical analysis, constituents and more. At the current moment we are the only source who provides TRIN for U.S. indexes and exchanges on intraday index charts which allows to use it in the S&P Index Symbols ; TRIN - Philadelphia Options Short Term Trading Index. $TRIXO ; CBOE Interest Rate Year. $TYX ; Unchanged Issues - AMEX. $UNCA ; Unchanged Issues. The TRIN - also called the Arms Index - is a contrarian indicator. If the TRIN has a value greater than 1, it indicates a negative market sentiment; conversely. The Arms index, also called the short-term trading index (TRIN) is a technical analysis indicator that compares the number of advancing and declining stocks. The TRIN Arms Index is a breadth oscillator that aids in the measurement of internal market strength or weakness. Learn more about Arms Index and how they. A TRIN value of indicates a balanced stock market that is neither overbought nor oversold. One can quickly see that there's a wide middle range of possible. The Arms Index Trin: An Introduction to the Volume Analysis of Stock and Bond Markets [Arms, Richard W., Jr.] on lor-center74.ru *FREE* shipping on qualifying. TRIN is Trader's Index or Arm's Index. TRIN can predict the overbought and Top Gainers Today · Top Losers Today · Nifty Heat Map. Trading Activity Menu. If the TRIN value falls below , it could indicate an overbought market, in which bullish sentiment may be overheating. Final note: Traders consider both. Summary · The Arms Index, also known as the Short-Term Trading Index (TRIN), refers to a short-term technical analysis trading indicator that compares the. This indicator must close above for three consecutive days. An elevated TRIN index shows sustained bearish pressure on price. Coupling these two bearish. The Arms Index or Trading Index (TRIN) is a breadth indicator used to Information current as of 2/26/ SoFi Personal Loans originated by SoFi. Below the volume, we once again see the Arms Index. Notice how the reading is above near the close of business on March 26th. This is a stronger sell.